santa clara property tax exemption

To claim the exemption the homeowner must make a one-time filing with the county assessor. Your total household income for 2021 was below 62292.

Paying Taxes Just Got Easier To Swallow In Santa Clara County Campbell Ca Patch

What is a Parcel Tax.

. Property taxes are levied on land improvements and business personal property. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. However most business can be conducted by.

Fremont Union High School District. Actually tax rates mustnt be increased before the general public is previously. April 15 - June 30.

8 rows All homeowners using their property as their primary residence are entitled to a 7000 reduction. Hedding StSan Jose CA 95110-1771. Where To Send Homeowners Exemption Form Santa Cl Claim For Homeowners Property Tax Exemption Santa Clara County Tax Walls can be downloaded to your computer by right clicking.

Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. 28 rows Parcel Tax Exemptions. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with.

School Districts may offer Special Assessment SA tax. If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the dwellings assessed value resulting in a property tax savings. SCV Water District Exemptions Info and Application.

These taxes are flat rate and are non-ad. Website for Exemption and Application Information. Santa Clara Valley Water District.

The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. In order to be granted an exemption for your property you must first submit an Application for County Exemptions.

Exemption Division - 408 299-6460. It also limits increases on assessed. We offer drop-in or appointment service for visitors to the office.

This translates to annual property tax savings of. You were born before June 30 1958. Parcel taxes are real property tax assessments available to cities counties special districts and school districts.

Santa Clara California Exemption Statement - Texas. If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the dwellings assessed value. 21a of the Texas Constitution.

You could be exempt from the tax if you meet all of the following criteria. If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the dwellings assessed value resulting in a property tax savings. The home must have been the principal place of residence of the owner on the lien date January 1st.

This translates to annual property tax savings of. County Government Center East Wing 70 W. SCV Water District Exemptions Info and.

Full in-person customer service resumes in the Assessors Office. It limits the property tax rate to 1 of assessed value ad valorem property tax. To claim the exemption the homeowner must make a one-time filing with the county.

Six duplicates with this form has to be carried out its. Santa Clara Valley Water District. In establishing its tax rate Santa Clara must respect Article VIII Sec.

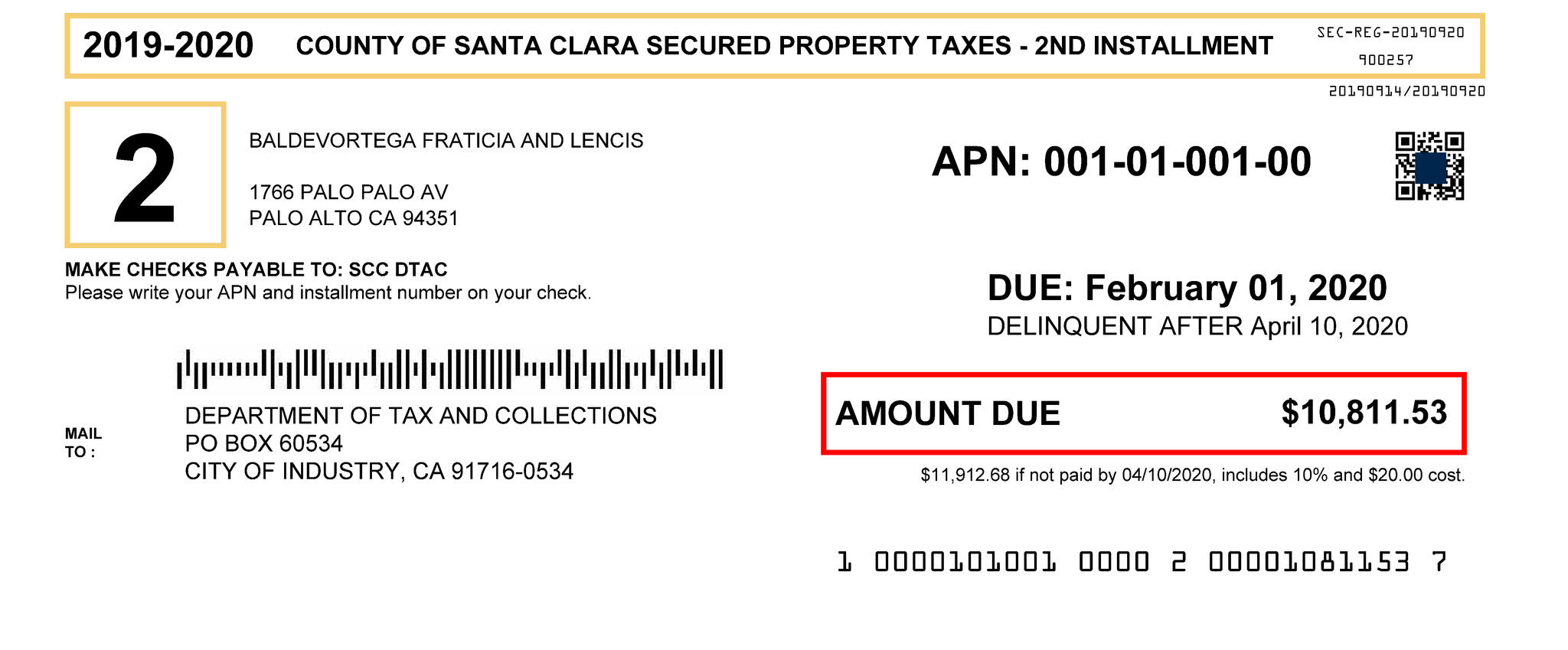

Second Installment Of Santa Clara County S 2019 2020 Property Taxes Delinquent After April 10 County Of Santa Clara Mdash Nextdoor Nextdoor

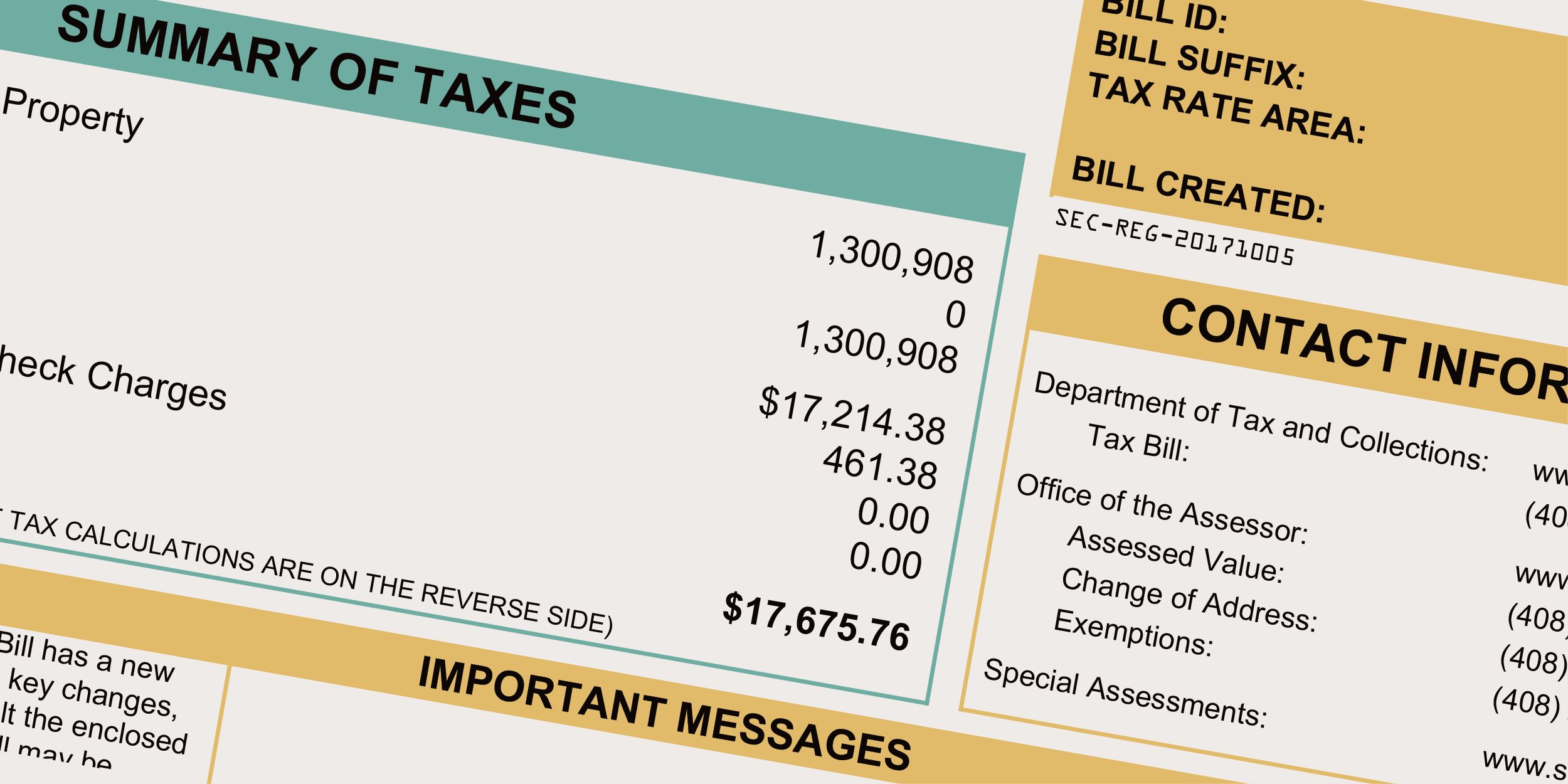

Property Taxes Department Of Tax And Collections County Of Santa Clara

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

County Of Santa Clara On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future

Affidavit Of Death Of Trustee Santa Clara County Fill Online Printable Fillable Blank Pdffiller

Business Owners Efile Property Statements

Official Map Of The County Of Santa Clara California Compiled From U S Surveys County Records And Private Surveys And The Tax List Of 1889 By Order Of The Hon Board Of Supervisors

Second Installment Of The 2020 2021 Annual Secured Property Taxes Is Due February 1 Ding Ding Tv 丁丁电视

Property Tax Re Assessment Bubbleinfo Com

Understanding California S Property Taxes

Stanford Wants Educational Tax Exemption For Faculty Homes News Almanac Online

Local Scene Candidate Forum Senior Property Tax Exemption Morgan Hill Times Morgan Hill San Martin Ca

Santa Clara County Office Of The Assessor Facebook

Santa Clara County Ca Property Tax Calculator Smartasset 2022

Santa Clara County California Ballot Measures Ballotpedia

Property Taxes Department Of Tax And Collections County Of Santa Clara

28 451 93 Reasons We Made This Client Smile Shannon Snyder Cpas

Guest View Who S Exempt From Parcel Taxes In Santa Clara County Morgan Hill Times Morgan Hill San Martin Ca